- Home»

- EverQuote Pro Blog»

- How To Get Life Insurance Leads: The Best (& Worst) Options For Agents

How To Get Life Insurance Leads: The Best (& Worst) Options For Agents

Selling life insurance can be a notoriously difficult and time-consuming process. Upwards of 90% of life insurance agents fail within their first year.

With a commission-only compensation base, selling life insurance requires having uncomfortable conversations, overcoming consumer beliefs about the need for life insurance, and convincing consumers to think about and plan for their own mortality. Add to that the complexity and length of the sales process and you have a laundry list of challenges that keep failure rates high and scare new agents away.

However, agents who do decide to embark on selling life insurance—and who are armed with the tools and processes to help them succeed—may find it to be one of the most lucrative insurance avenues available. (We wrote about the many upsides of selling life insurance in this article.) But one of the keys to making six figures in life insurance sales is knowing where to find the people who are buying it. In this article, we’ll discuss the best—and worst—places to look for leads if your agency is selling (or considering selling) life insurance.

Calling all agents! Make sure your producers are set up for success. Download the Insurance Agent Sales Process Quick-Start Template today.

How To Get Life Insurance Leads: The Best (& Worst) Options For Agents

Best Options

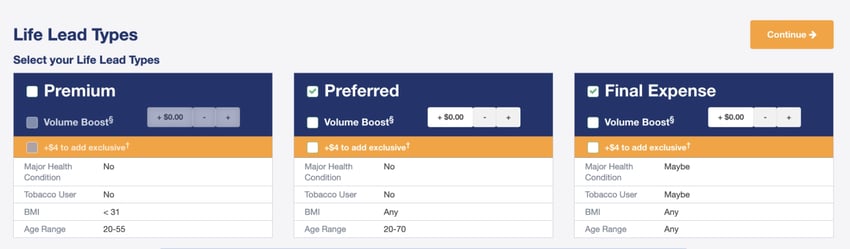

Warm Internet Leads

When a prospect searches for insurance-related terms via a search engine (for example, “car insurance quote,”) which then connects them to a website, that person is considered a warm internet lead (also sometimes referred to as a “warm online lead” or “qualified lead.”). The consumer then fills out a questionnaire related to the insurance product(s) they’re interested in and consents to sharing the information with an insurance agent, who can then deliver the prospect a quote.

Warm insurance leads are people who have expressed an intent to buy insurance, so it’s likely agents will have a chance to talk to them and potentially close a sale. In our opinion, warm internet leads are one of the very best types of life insurance leads because they have a high close rate and help agents fill their pipelines if they don’t have the time to gather leads themselves.

The biggest drawback of warm internet leads—and what makes them inaccessible for some agents—is their cost. Partnering with warm online insurance lead companies can cost more than obtaining other types of leads. However, don’t let the initial “sticker shock” keep you from pursuing these leads. Over time they produce an excellent ROI, and agents tend to consider them a worthwhile investment—especially when you factor in things like renewal revenue, the long term ROI potential and the time it would take to generate the same amount of business from cold leads.

EverQuote has the ability to provide you with qualified life insurance leads based on millions of calls, dozens of best practices, and years of experience. And when you partner with EverQuote, you get more than just leads: We also help all our partner agents learn how to optimize their leads and improve their processes for maximum return.

Unlike some vendors, EverQuote does not resell leads at a future date. That means you can work your leads and continuously follow-up until you make contact, without having to worry about new competition from the same source. So if we send you a life insurance lead, it’s up to you to dig in and find out what the client needs.

We’ve helped hundreds of agents accelerate their growth. You can read about some of our success stories here.

Relationship Building

You’re not just contacting leads. You’re contacting people who are concerned enough for the wellbeing of their loved ones that they’re interested in finding a life insurance policy.

Did these folks go online and fill out the pertinent information in order to get a quote? Sure. But if you lead with the quote (or make your conversations all about the quote and the policy) you’re making it clear to your potential clients that you view this as a transactional relationship only.

The key to winning in the life insurance business is to build real connections with your clients based on trust, empathy, and professionalism. Your clients want to know you have their best interests—and those of their loved ones—at heart when you’re helping to find them a policy. There are a number of complex, often difficult emotions that people go through when shopping for life insurance, so the last thing you want to do is make your clients feel like they’re nothing more than a revenue stream.

Yes, you will need to tackle details like getting your prospects’ height, weight, age, BMI, and so forth in order to give them a quote. But as you’re talking with them, try to uncover the why behind their search for life insurance. Find out who they are as a person, uncover this why, and you’ll build trust and find a happy customer for the long term.

Cross Selling

Cross selling – or maximizing your book of business by trying to sell additional products to your existing customers – is a crucial part of many agents’ sales strategies. For example, if you sell an auto policy to a customer, you might call them again six months later to see if they want to bundle it with a different type of policy. This tactic helps agents retain business because it’s harder for customers to cancel many policies vs. just one—you can see the benefits plainly.

Insurance Reviews

This is similar to cross-selling in that you’ll be contacting existing clients. However, you don’t necessarily need to sell them on a whole new product. Whereas a cross-selling approach involves contacting a current home insurance customer and starting a conversation about life insurance, an insurance review involves reaching out to existing life insurance clients to make sure their needs are being met.

- Are they happy with their policy?

- Would they like to increase coverage now that they’ve had a few months to get accustomed to carrying life insurance?

- Are there any gaps in coverage they’d like to fill in?

- Would their spouse be interested in a life insurance policy as well?

And so on.

Rarely will people take the time to reach out on their own if they are mostly satisfied with their existing policy coverage. However, by conducting reviews with your existing clients, you can keep that relationship alive. You can also take advantage of upselling opportunities that weren’t possible when you initially onboarded these customers, because you hadn’t yet had the chance to build that relationship.

Referrals

When a satisfied customer refers someone else to your business and that person becomes a client, that is called a referral. (This article is chock full of expert advice for building a referral network!) Referrals are generally an easy close, and the small cost involved in acquiring these leads makes them an incredible value.

Cross-selling and referrals help agents retain customers, and there are really no disadvantages to using cross-selling and referrals to generate life insurance leads. However, most agents can’t run their businesses on these two types of leads alone – there typically just isn’t enough volume. This is why these agents (and probably you, too) have to look for other ways to get reliable life insurance leads.

Your Website & Search Engine Optimization (SEO)

These are two separate tactics that should be employed together for maximum benefit. All agents should have, at a minimum, a basic website for their agency describing the products they offer and providing contact information. Many people purchasing insurance have trouble bridging the trust and legitimacy gap unless they see their agent’s website, so this method is well worth the effort. Creating a website is inexpensive, and many agents are provided a free website through their carrier.

Once your website is up and running, you can apply SEO strategy to generate your own leads in-house via the internet and your knowledge of search engines. Agents who utilize SEO, either on their own or by hiring an agency or consultant who specializes in SEO, work to create informational content around insurance-related topics that search engines like Google will notice. Producing high-quality content can help your agency show up on the first few results pages of sites like Google, making you more visible in the eyes of your customers who are looking for solutions.

Cost is one downside to this method of life insurance lead generation. Unless you have a lot of money or a very large insurance business, in most cases you will get only a limited number of leads. SEO also requires a substantial time investment—you’ll either need to hire someone to do SEO or do it yourself, which will take time away from more valuable tasks.

Expert Branding

When someone in your area thinks of life insurance, you want your name and face to pop into their minds. You want to come across as an expert in your field, a source of valuable information, and someone who can be trusted to help your clients find the exact right solution for their needs.

Thankfully, you can accomplish a lot of this by nurturing your online presence. This goes hand-in-hand with the website and SEO strategies mentioned above.

Two great ways to brand yourself as a life insurance expert are to publish helpful, informative content regularly and be active on social media. However, be careful not to come across as too “salesy” with either of these avenues. You want potential customers to find you and think, “Wow, I just learned something really helpful!” rather than be turned away by obvious advertisements.

Try a mix of these ideas and see what generates the best results for you:

- Write and publish informative blog posts. Think of topics your customers ask on a regular basis—”Do I really need life insurance?” “How much should I budget for a life insurance premium at fifty years old?” etc. Then turn them into articles that educate your readers and build their confidence in you as an expert.

- Post engaging videos of life around your office and community. Getting your face and personality—as well as those of your agents—out there will go a long way toward building brand recognition.

- Reach out to your social media contacts and wish them a happy birthday, good luck on the grand opening, etc. Show people that you’re an active member of your community, and that your contacts are more than just sources of potential revenue in your mind.

- Get your audience laughing along with you by posting funny (but tasteful) memes.

Less Effective Options

Cold Insurance Leads

Also known as cold online insurance leads, these people did not request a life insurance quote and likely do not intend to purchase insurance. Instead, they submitted their contact information for purposes of participating in internet pop-up surveys, raffles, Facebook games, etc.; that information is then passed along in the form of a cold lead. Cold lead generation is basically the online version of going through phone numbers in a phone book—they are not recommended and typically have very low conversion rates.

Many agents are drawn to cold life insurance leads because they are not as expensive as warm leads. But while the cold leads may seem cost effective on the surface, the real cost is in the amount of labor hours it takes to work them to generate any potential business. In some cases, they may be helpful if you have time to make a high volume of cold calls or to comb through numbers in a specific area, but with close rates barely at 1%, they cost you time and dedication for little to no return on your investment.

Lead Aggregators

Lead aggregators resell leads they purchase from other websites—they don’t generate their own leads. Leads purchased from aggregators are typically less expensive, and you can buy large lists of leads as often as is helpful for your business. For some agents, these lists can be good for reaching out to people when they hit the six-month renewal mark for their existing policy (at which point they will very often be much more receptive when it comes to shopping for new quotes).

However, aggregators have a lower price point because their leads are not delivered in real time and because they often have a high share rate—with the cheaper leads being shared among multiple (sometimes dozens) of other agents.

Life insurance leads from aggregators are generally less likely to lead to a sale because they may have already signed up with another agent, or decided not to change the insurance products they already have. As a result, you could end up wasting money and time, which is why we don’t recommend this type of life insurance lead.

Cold Calling

This life insurance lead type involves calling numbers from a list of leads with the intention of giving a sales pitch, but without having had any prior contact with the individuals you’re calling. This is a cheap way to generate leads—for $10–$15/hour, you can generate potential clients, but it’s not a skill many producers have, or one that is efficient in producing ROI.

Just think about getting an unexpected phone call (or text or email) from someone you don’t know. What are the chances you’d talk to them about insurance? It’s hard enough for many agents to get people to stay on the line if they’ve shown interest or intent, so what makes us think it gets any easier without those things? For this reason, we don’t recommend cold calling life insurance leads unless you have an abundance of producers and time on your hands.

Choosing Your Life Insurance Lead Generation Path

For most agents, the path to success in life insurance sales includes trying out and testing a variety of life insurance leads. We’ve highlighted some of our favorites (and some we don’t recommend), but don’t take our word for it! Get different types into your producers’ hands and measure what works best for you.

The key to success with most lead sources is persistence. The agency that wins is the agency that never gives up.

At the end of the day, lead pipelines are just that: Pipelines. It’s up to you, the expert in a complicated field, to help turn internet and phone leads into customers—and hopefully friends—for life.

If you’re interested in trying warm life insurance leads, we hope you’ll consider partnering with a firm that provides high-quality insurance opportunities via the internet—like EverQuote!

When you partner with us, you not only get warm leads, but you also have the opportunity to learn about best practices for sales, what works and what doesn’t when talking with internet leads, and more. With EverQuote, you have complete control over your leads. And you can pause your account at any time, with no consequences. Click here to get a tour of EverQuote’s tools with one of our experts.

Unlock predictable growth with EverQuote.

Our representatives are standing by to help you succeed.

Call 844-707-8800

Weekdays, 9AM-5PM (ET)

Call 844-707-8800

Weekdays, 9AM-5PM (ET)

Accelerate your growth.

Complete the form below or just call 844-707-8800 to learn how we can help you achieve your goals.

By clicking "Get Started", I consent by electronic signature to being contacted by EverQuote, including by automatic telephone dialing and/or an artificial or prerecorded voice (including SMS and MMS - charges may apply), regarding EverQuote for Agents, even if my phone number is listed on a Do Not Call Registry. I also understand that my agreement to be contacted is not a condition of purchasing any goods or services, and that I may call (844) 707-8800 to speak with someone about EverQuote for Agents.

By clicking "Get Started", I affirm that I have read and agree to this website’s Privacy Policy and Terms of Use, including the arbitration provision and the E-SIGN Consent.

* Mandatory fields

Product Overview

Product Overview Blog

Blog FAQs

FAQs Webinars

Webinars eBooks & Resources

eBooks & Resources