- Home»

- EverQuote Pro Blog»

- Why Use Insurance Telemarketing Services In Your Agency?

Why Use Insurance Telemarketing Services In Your Agency?

If you had to name the most tedious, time-consuming, thankless task in your insurance sales job, what would it be?

Unless for some reason you’ve been tasked with scrubbing the floors with a toothbrush, you probably answered lead outreach.

Prospecting for new clients involves making countless phone calls, sending untold numbers of emails, enduring numerous grumpy responses from people who don’t want to talk on the phone right now, and getting hung up on repeatedly. Sure, lead outreach is the bread-and-butter of garnering new business and your agency likely wouldn’t survive without it, but contacting leads isn’t exactly on most agents’ lists of fun things to do.

That’s where insurance telemarketing services come in. If you’ve never considered having a dedicated telemarketing service take over your lead outreach, stay tuned. You might be surprised to learn how worthwhile the return on investment can be and how much time you can save by switching to an effective telemarketing service.

Contact EverQuote to boost your business with warm leads and our convenient LCS telemarketing service.

Here’s what you need to know about insurance telemarketing services.

What are telemarketing services for insurance agents?

Think of the thousands upon thousands of phone calls your agency makes and prospecting emails your team sends every month in the pursuit of landing new clients. How much time do your agents spend dialing number after number and sending email after email?

Now imagine if you could still get the benefits of making all those calls—you still find new, interested clients and bring them on board—but with the leg work being handled by a professional telemarketing team that specializes in outreach to insurance leads.

That’s the idea behind insurance telemarketing services in general—and EverQuote’s Lead Connection Service (LCS) in particular.

Let’s talk about the benefits you can expect from outsourcing your lead outreach to LCS.

Our telemarketing team will reach out to warm leads seconds after they request information, have a skillful, targeted conversation to confirm the prospect’s information, and then funnel the interested parties your way. They’ll also conduct email outreach to prospects with emails that highlight your agency by name, so when you connect with a prospect they are better prepared for a conversation with you. Meanwhile, your agents are free to tackle more impactful, revenue-generating work since they no longer have to wear their fingertips down dialing the phone and sending prospecting emails.

Over the first seven days after the lead submits their information, we’ll follow a predetermined cadence of phone calls and emails with the goal of catching the largest number of potential customers. And, since there are so many marketers conducting outreach on your behalf, the results usually far exceed what you could accomplish by making outbound calls and emails in-house with just a handful of agents.

To put it in perspective: If you’re used to contacting 100 leads per day in your agency, Monday through Friday, our Lead Connection Service would save you from having to make about 24,000 phone calls and just as many (or more!) emails over the course of a year. Your agents can put a lot more effort into helping clients and writing new business when they don’t have to deal with that time-sink.

Crucially, offloading the responsibility of lead outreach saves more than just time. It also saves an incredible amount of brain power that can be better used to provide high-quality service to folks who are lower in the funnel.

Plus, expert telemarketers who train specifically for insurance lead outreach often drive higher lead to quote conversion rates compared with producers who may feel worn down by the sheer workload of making all those calls and emails. Trained insurance telemarketers know the industry; they’re hired for their ability to get warm leads on the phone and transfer prospects to you right away so your agency can start drawing up a quote.

Additionally, we’ll send you the information for every lead you purchase from us, even if the original telemarketing efforts didn’t result in a prospect getting transferred to your phone. This means you can always follow up with these leads in the future and increase your chances of catching potential customers who weren’t ready for a quote right away. It also means your agents can continue to do lead outreach of their own if they choose to.

Combining in-house efforts with telemarketing services can skyrocket your sales - with 31% average bind rate increases according to one major carrier’s testing - and help to prevent slumps when times are tough.

To sum it all up, insurance telemarketing services save time, keep your agents happier, and often result in more business flowing to your agency.

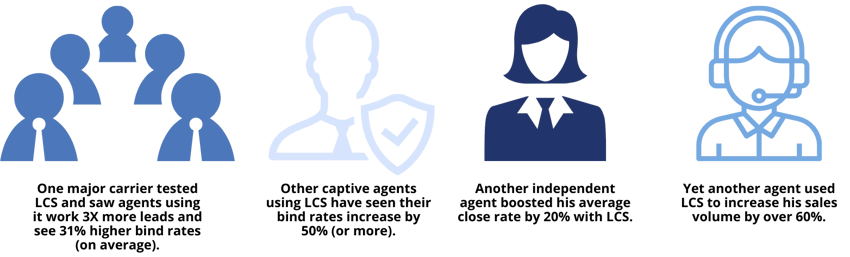

These case studies show the results real clients have obtained from using EverQuote’s Lead Connection Service.

If you’ve never used one before, it can feel like a big commitment to sign up for a telemarketing service. It’s always a little bit nerve-wracking to take on another monthly payment—even if it’s a small one—without a guaranteed ROI.

To give you an idea of what you could accomplish in your agency by opting for LCS over traditional lead connection methods, take a look at these real-world results from our clients:

- One major carrier tested LCS and saw agents using it work 3X more leads and see 31% higher bind rates (on average)

- Other captive agents using LCS have seen their bind rates increase by 50% (or more)

- Another independent agent boosted his average close rate by 20% with LCS.

- Yet another agent used LCS to increase his sales volume by over 60%.

In short, agents who use LCS tend to have far fewer headaches and outperform agents who don’t.

Are insurance telemarketing services the right fit for your agency?

That depends.

Telemarketing services can be a huge convenience, especially for medium- to large-size agencies that churn through a high volume of leads on a regular basis. The cumulative time saved from taking phone calls off your producers’ to-do lists can be immense when you have several team members who normally make dozens or more calls per day.

Smaller agencies can still benefit from LCS. Even if you work through ten calls per work day instead of a hundred, that’s still 2,400 calls you don’t have to make on a yearly basis—which is quite a lot if you’re a solo agent or only have a couple of partners.

With that said, smaller agencies will need to make sure they have a CRM in place that can integrate with LCS. If you don’t already have one, this is an extra expense you’ll have to take into account (although adding a CRM will provide benefits beyond just its integration with LCS).

From there, you’ll want to decide whether the monthly cost investment will be easily canceled out by the increase in sales you’ll receive from a telemarketing service. Some services charge thousands of dollars per month, which is often too steep for small to mid-size agencies to handle. Even if you deal in large volumes, you’ll still have to make a significant amount of extra sales to make the high monthly cost worthwhile.

EverQuote’s LCS is much more affordable, at less than ten dollars per day under most circumstances. You’ll earn back your investment with the first sale you make each month.

Plus, by working with us you’ll get the benefit of growing together with one of the largest and most trusted lead generation companies in the industry. Think of it as a stress-proof way to grow your business without having to find, hire, and train new staff to handle a larger workload.

Contact EverQuote to start receiving warm leads and telemarketing help right away.

Unlock predictable growth with EverQuote.

Our representatives are standing by to help you succeed.

Call 844-707-8800

Weekdays, 9AM-5PM (ET)

Call 844-707-8800

Weekdays, 9AM-5PM (ET)

Accelerate your growth.

Complete the form below or just call 844-707-8800 to learn how we can help you achieve your goals.

By clicking "Get Started", I consent by electronic signature to being contacted by EverQuote, including by automatic telephone dialing and/or an artificial or prerecorded voice (including SMS and MMS - charges may apply), regarding EverQuote for Agents, even if my phone number is listed on a Do Not Call Registry. I also understand that my agreement to be contacted is not a condition of purchasing any goods or services, and that I may call (844) 707-8800 to speak with someone about EverQuote for Agents.

By clicking "Get Started", I affirm that I have read and agree to this website’s Privacy Policy and Terms of Use, including the arbitration provision and the E-SIGN Consent.

* Mandatory fields

Product Overview

Product Overview Blog

Blog FAQs

FAQs Webinars

Webinars eBooks & Resources

eBooks & Resources