- Home»

- EverQuote Pro Blog»

- What is the best insurance to sell?

If you’re considering entering into the insurance industry in 2022 and trying to figure out where you should land, one of the first things to investigate is what type(s) of insurance products you might want to sell. Will you focus on P&C, auto, life, commercial, or some combination of them? This decision will impact whether you decide to become a captive or independent agent, and it can also have a huge impact on your potential income in both the short- and long-term.

In this article, I’ll share my thoughts on the following:

- What is the best insurance to sell

- Which products make you the most money quickly

- How you can sell more, no matter what insurance vertical you choose

What is the best insurance to sell?

If I was limited to selling only one single type of insurance product, it would be commercial insurance. That is, anything business-related: personal, auto, fire, etc. Commercial insurance is one of the most long-term, viable products for generating income because it’s one of the few verticals that can’t be automated.

Other segments, like auto insurance sales and homeowner insurance sales, will be (and in many cases already are) undergoing massive evolutions—cars are getting smaller, people are getting into fewer car wrecks, computers are figuring out how to automate insurance products. As a result, competition is continuing to increase and more and more agents are getting shut out of these once-popular verticals.

This is simply not the case with commercial insurance. People can’t buy a commercial insurance policy on their own—they need an agent to meet with them and review risk exposures, systems and processes, and coverages regularly. These time-consuming tasks provide opportunities for agents to shine, because no one in a company has the time, insurance background, or industry knowledge to do it on their own. They need an agent.

- Most large, independent agencies sell mostly commercial insurance.

- Commercial insurance is a continually growing market and in 2020 represented about 48% of all premiums written in the US. P&C companies are looking more at commercial products because they see the writing on the wall when it comes to the future of the market.

- Commercial insurance is one of the most complex insurance products sold.

- Commercial insurance is the most insulated type. It changes constantly, and is difficult and not profitable to automate (at least not yet!).

- Commercial insurance customers don’t like to leave. They don’t like to go through loss history, ratios, pulling up reports and figuring out how to redo policies, etc. It is typically a very loyal vertical once you’ve closed a sale.

Why don’t more agents choose to sell commercial insurance?

In a word, complexity.

Not everyone will do it because it’s a lot of work. There’s a big learning curve in understanding commercial insurance, and it takes legwork to break into the market, meet with prospective clients and figure out what they need. However, it’s because of this complexity that the job can be so rewarding.

Once you’ve figured out how to sell commercial insurance, you won’t lose your clients anywhere near the rates common with consumer P&C insurance. Business owners value time, simplicity, and routine; they don’t like to change things like insurance policies, because that change requires time away from the tasks that make them money. If you’re treating your existing customers well, they won’t leave you for a price change—that’s small money compared to the time and effort they’d have to spend to get a new commercial policy altogether.

Which products make you the most money quickly?

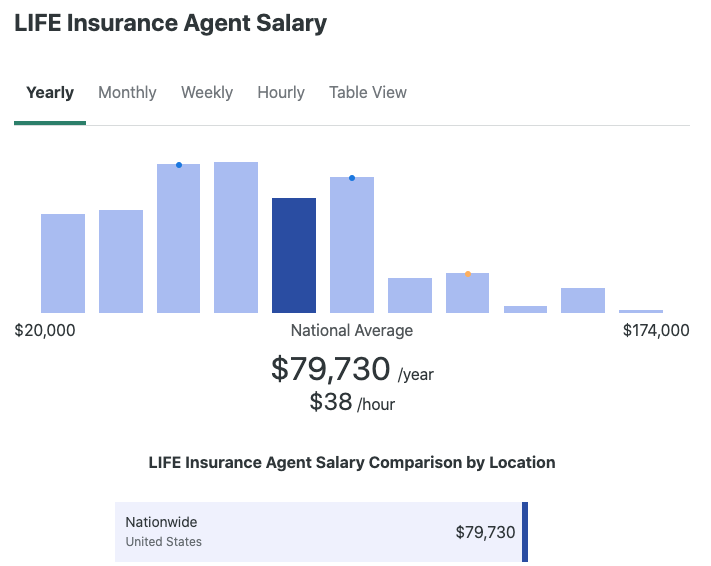

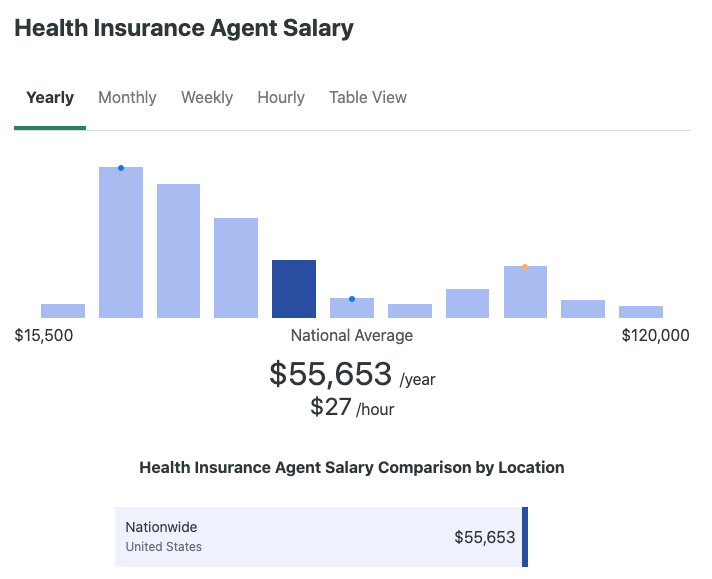

According to ZipRecruiter, life insurance agents make an average of $79,730 nationwide—that’s the highest-paid of all the products listed below. Commercial, which I’ve mentioned is my choice, is listed third. So while commercial still ranks high here, I take these sort data breakdowns with a grain of salt, as they often lump anyone licensed to sell a particular product into the category of “agent” (so sales producers along with agency owners). They also look at an average across the United States, and a commercial agent in a predominantly rural area is probably not going to have the same salary potential as an agent working in an urban area.

How You Can Sell More In Any Vertical

1. Sell more than one type of insurance.

If I had to pick just one I’d choose commercial, but I would never choose just one if I could avoid it. Diversifying is what will keep you afloat as different insurance products experience instability. If you learn anything from this article, it should be the importance of getting multiple product licenses, and then selling them!

2. Pay attention to niche insurance products.

The money in the industry is in niche products. If you can get a license to sell products that are more specific and encounter fewer competitors, pursue it. Some niche products include medicare supplement insurance, medical insurance for doctors/physicians, insurance for commercial rental properties (think Airbnb), commercial transportation insurance, business insurance (fire, theft, liability, etc.), and many others.

3. Your sales process is everything.

You will never reach your potential as an insurance agent if you don’t have a consistent, proven sales process. You won’t be able to grow and scale your agencies; your team won’t provide the same baseline customer experience; and you’ll fail to reach your goals. (If you don’t have a set of processes nailed down yet you can get access to ours here: The Insurance Agent Sales Process Quick-Start Template.)

4. Fill your pipeline with high-quality leads.

No matter what type of insurance you sell, at some point, you’re going to need high-quality leads to help you fill your pipeline. That’s where EverQuote comes in. EverQuote is one of my trusted partners. In my agency, I appreciate that they really go above and beyond when it comes to working with me to help ensure I get the best results with their leads. Most lead vendors send you leads and take your payment. EverQuote is the only one that truly invests in their clients’ success. They’ve not only paired me with a dedicated Business Consultant who helps analyze my results with EverQuote leads and makes data-focused recommendations, but they are also invested in creating some amazing agent-focused resources. (Check out their weekly webinars featuring top agents from around the country sharing the “secret sauce” to what makes them so successful.)

Ready to see what partnering with EverQuote can do for your agency? We’re ready to help you succeed. Call 844-707-8800, or contact us online to get started.

Unlock predictable growth with EverQuote.

Our representatives are standing by to help you succeed.

Call 844-707-8800

Weekdays, 9AM-5PM (ET)

Call 844-707-8800

Weekdays, 9AM-5PM (ET)

Accelerate your growth.

Complete the form below or just call 844-707-8800 to learn how we can help you achieve your goals.

By clicking "Get Started", I consent by electronic signature to being contacted by EverQuote, including by automatic telephone dialing and/or an artificial or prerecorded voice (including SMS and MMS - charges may apply), regarding EverQuote for Agents, even if my phone number is listed on a Do Not Call Registry. I also understand that my agreement to be contacted is not a condition of purchasing any goods or services, and that I may call (844) 707-8800 to speak with someone about EverQuote for Agents.

By clicking "Get Started", I affirm that I have read and agree to this website’s Privacy Policy and Terms of Use, including the arbitration provision and the E-SIGN Consent.

* Mandatory fields

Product Overview

Product Overview Blog

Blog FAQs

FAQs Webinars

Webinars eBooks & Resources

eBooks & Resources