- Home»

- EverQuote Pro Blog»

- Insurance Cold Calling: The Ultimate Guide

Insurance Cold Calling: The Ultimate Guide

Ask any insurance agent or producer their thoughts on insurance cold calling, and you’ll quickly learn—it’s the worst. Even for experienced agents, insurance cold calling can feel like it’s fraught with all sorts of problems:

- You have limited information about the person you’re calling.

- You never know who’s going to pick up on the other side of the line.

- They may not be interested in learning about your products or your agency.

- You don’t know how they’ll react to you contacting them.

Because of all these unknowns, cold calling is typically a low-ROI activity compared to contacting leads gained from referrals or purchasing qualified online leads.

Cold calling is not the way most agents or producers would choose to spend their time. However, it is almost always something you or your producers will have to do. (Tweet this!) So the goal is to master it as much as you can. In this article, we’ll break down what you can do to make the time you spend cold calling as effective as possible, and share some scripts you can use each and every time you make cold calls.

Why would you need (or want) to cold call someone?

For new agents especially, insurance cold calling is an inexpensive way to establish contact with people, particularly if they can't afford to outsource lead generation.

Does insurance cold calling actually work?

Unfortunately for agents with an aversion to it, yes, cold calling can be a successful part of your lead generation game plan. Will it be the most successful strategy you use, or land you the biggest number of leads for the time spent? Probably not. But if you have new agents or producers who are just familiarizing themselves with the idea of selling insurance, or you have producers with extra time to fill, cold calling is a good opportunity.

But in order to make the most of each dial, you need a plan.

How To Cold Call Effectively: 8 Insurance Cold Calling Best Practices

Before Initiating A Cold Call

1. Prepare.

Before you reach out to a lead, do your research with as much information as you have. You probably won’t have a lot of information to work with, but don’t call someone without knowing as much as you can about them.

2. Use scripts to help guide your conversation.

You don’t want to sound like a robot on the call, but using a loose script can help you clearly communicate your points and convey the benefits of the products you’re selling. (Keep reading for some example scripts we recommend for our insurance partners.)

3. Practice and personalize your scripts.

As you rehearse and practice your scripts, you’ll learn what sounds natural and what you should add or change. Try practicing out loud in front of a mirror, and with someone else who can provide feedback on what works and what doesn’t.

If you’re looking for specific scripts to follow, check out this free whitepaper: 4 Example Scripts To Help Agents Handle Consumer Objections

4. Be in the right frame of mind.

Mindset is crucial to cold calling—agents and producers must believe they are providing value to the people they’re calling. Without this belief, their doubts can easily manifest over the phone and cause doubt in the minds of prospects. Believe you are helping people make a positive change in their lives with the products you provide, and that you are genuinely helping them. This is, of course, easier to do if you believe in the product you’re selling.

Making The Call

5. Call right away.

To help avoid falling into “call reluctance,” call as soon as possible. Once you’ve completed adequate research on the lead (where necessary), don’t hesitate to pick up the phone and dial out immediately.

6. Know how to handle objections.

Especially when cold calling insurance leads, you will face objections. There are four things you should do to counter their objections and keep them on the line:

- Don’t lead with an insurance pitch.

- When a person objects, don’t argue with them.

- Provide value.

- Project good vibes only.

7. Schedule another call if they can’t speak right away.

When a lead says they can’t talk, provide two or three alternative times, so they have less of an opportunity to give you an outright “no.” Ask what times of day work for them, and be as accommodating as possible.

After The Call

8. Follow up after the call.

Agents often lack persistence when it comes to following up, which is why top agents like Mark Jameson recommend having a follow-up process in place. Follow-up calls and emails are key to an agent’s success. But you may need multiple calls and/or emails (10 touches are sometimes required to achieve a single sale!) to see results. Don't be afraid to talk to your leads—it’s not going to hurt you if they say no. (You can download Mark’s defined sales process here to learn exactly how he does it in his own agency.)

Insurance Cold Calling Tips & Best Practices

- When you’re making calls, take note of those you feel you did well on and those where you struggled. You can also use a recording service so you can go back and listen to calls, identifying what you did well and what you could improve upon. Using those insights, you can try to improve on your next call. This can help prompt you to think differently, and make you more precise and careful with your words.

- Network with industry peers and colleagues about what’s working for them. What are other agencies and producers doing well? What are you doing well that you can share? Collaboration is very helpful in identifying what may potentially work for you as well as what you could eliminate.

- When contacting cold leads, be cognizant of federal and state laws that address emailing, calling, and texting consumers for marketing purposes. For example, there are laws prohibiting the use of auto-dialers, laws ensuring opt-out or do-not-call requests are honored, and many more—you need to be aware of all of these!

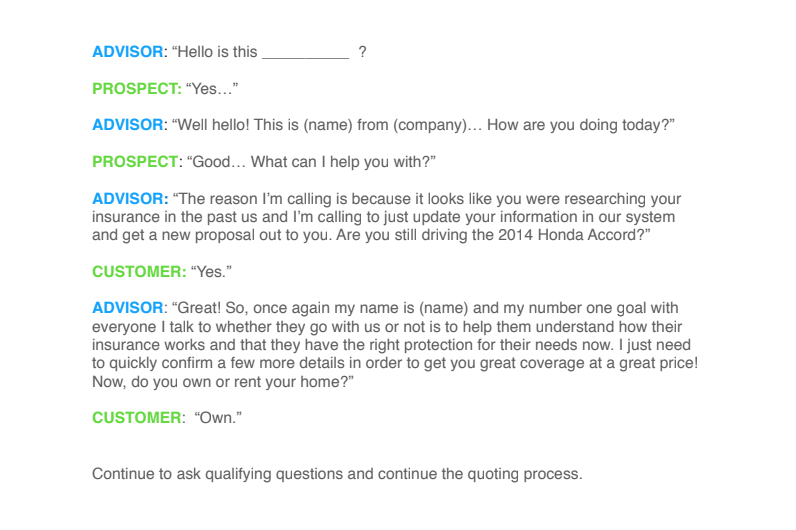

Cold Calling Scripts For Insurance: An Example

Here’s one example of a cold calling script from one of our partners, Role Play at the Olson Agency:

How do EverQuote leads help with your sales process?

While you’ll probably need to cold call people at some point in your career, when possible, we suggest you move from dialing numbers at random to dialing qualified leads sourced from EverQuote. Here’s why: Cold calling is no match for EverQuote’s level of sophistication when it comes to putting you in contact with people who are actually interested in buying insurance.

Instead of buying massive lists of names identifying people who may have filled out a form six months or a year ago, EverQuote attempts to identify people who are actively shopping for auto insurance and are looking for some level of comparison. We have dozens of data scientists and analysts who hone in on how to capture the right leads that best align with a captive agent. Then, we provide auto insurance leads directly to you seconds after the consumer submits their form, so you can contact potential clients immediately—while they’ve still got insurance on their minds.

As our partner, you’ll also benefit from ongoing training and help, including a business consultant who explains our processes and how we provide you leads; proven talk tracks and scripts to help you on your calls; and coaching on your follow-up strategy.

Interested in a trial of EverQuote?

There are millions of potential clients currently looking for an auto insurance quote‚ and we can connect you to them! Just contact us to get started today.

Unlock predictable growth with EverQuote.

Our representatives are standing by to help you succeed.

Call 844-707-8800

Weekdays, 9AM-5PM (ET)

Call 844-707-8800

Weekdays, 9AM-5PM (ET)

Accelerate your growth.

Complete the form below or just call 844-707-8800 to learn how we can help you achieve your goals.

By clicking "Get Started", I consent by electronic signature to being contacted by EverQuote, including by automatic telephone dialing and/or an artificial or prerecorded voice (including SMS and MMS - charges may apply), regarding EverQuote for Agents, even if my phone number is listed on a Do Not Call Registry. I also understand that my agreement to be contacted is not a condition of purchasing any goods or services, and that I may call (844) 707-8800 to speak with someone about EverQuote for Agents.

By clicking "Get Started", I affirm that I have read and agree to this website’s Privacy Policy and Terms of Use, including the arbitration provision and the E-SIGN Consent.

* Mandatory fields

Product Overview

Product Overview Blog

Blog FAQs

FAQs Webinars

Webinars eBooks & Resources

eBooks & Resources