- Home»

- EverQuote Pro Blog»

- How To Become A Successful Part Time Agent

Being an insurance agent can be difficult, especially at first—only about 8% of new agents survive their first year in business. It’s hard to jump into full-time insurance work and everything that comes with it— learning the industry, getting licensed, and handling the stress of sales.

For many people, it works better to enter the insurance field—which is commission-based—in a gradual way, including keeping a “regular” job to pay the bills. Essentially, that equates to being a part-time insurance agent. In this article, we’ll discuss how to become a part-time insurance agent and the benefits of part-time work, especially at the beginning of your career.

How To Become A Part-Time Insurance Agent

In terms of licensing and examinations, the process of becoming a part-time insurance agent is exactly the same as for a full-time agent; you can read about that process in detail in my article, How To Pass The Life Insurance Exam: A Go-To Study Guide.

Here is a brief overview of how to become licensed:

1. Commit to the process of getting licensed: taking the classes, studying, and taking practice tests. I recommend you use online license study services such as ExamFX to study and prepare for your license exam.

Knowing your insurance sales process works is crucial to your success—does yours measure up?

Make sure by downloading our free guide: The Insurance Agent Sales Process Quick-Start Template

2. Pay for and pass your insurance licensing test. Costs vary by State to take the licensing exam – it’s generally around $50.

3. Once you are licensed, decide whether to work with a captive or independent agency. Check to see if the agency you are looking to work with offers licensing prep or provides access to an online license study service. For agents who want to work part-time, working for an independent agency can be a great first job in the insurance industry because there are often more opportunities available. However, captive agencies typically offer better training.

Tips For Getting Paid More Right Out Of The Gate

- Whether you are looking into captive or independent options, it is recommended you research the average comp percentage offered and negotiate as best you can.

- Learn how to unlock higher tiers of pay as you progress.

- Talk to recruiters and get multiple offers before you pick the right overall best place for you.

- If you plan to build a team, carriers typically pay these agents more.

4. Get appointed. This step is specifically for agents that go the independent route (as opposed to captive who generally sell products from one specific company). “Getting appointed” means you’ve been authorized by an insurance company with the authority to act on its behalf as an agent. Once you’re appointed, you’re able to sell multiple insurance products from that company.

5. Get the necessary equipment and technology access from your carrier. This step looks different from carrier to carrier and in an independent vs. captive carrier situation, but typically you’ll need all your technology log-ins, a computer or tablet to use when meeting with customers, and any proprietary software and training modules from the carrier. Eventually, you may also want to adopt additional software and tools that can help your agency run more efficiently.

6. Find a consistant way of getting new clients. Once you’re ready to set up shop, you need to focus on how you’ll bring people in the door, so to speak. Clarify your marketing and lead generation strategy. At EverQuote, we’ve written extensively about both of these things on our blog (take a look and subscribe here). You can also partner with a vendor to start generating new business quickly. Make sure to use a reputable partner like EverQuote – the largest insurance marketplace in the US – who can connect you with customers seeking your services in real time.

Check out some of our other related guides and resources:

- EverQuote’s Sales Best Practices

- The Insurance Agent Sales Process Quick-Start Template

- A Winning Insurance Sales Conversation Process in 8 Steps

- 10 Things Every Agent Should Be Doing (But That Most Aren't)

Benefits To Becoming A Part-Time Insurance Agent

Ramping up as a part-time agent has a number of advantages:

- Part-time agents can get licensed, train, and work at their own pace while holding down another job. This approach is less of a financial risk than working as a full-time agent.

- Some carriers allow part-time agents to do telesales. This can be beneficial if you are working part-time and don’t want to meet face-to-face or don’t have an office.

- Part-time agents can run their business on their own schedules.

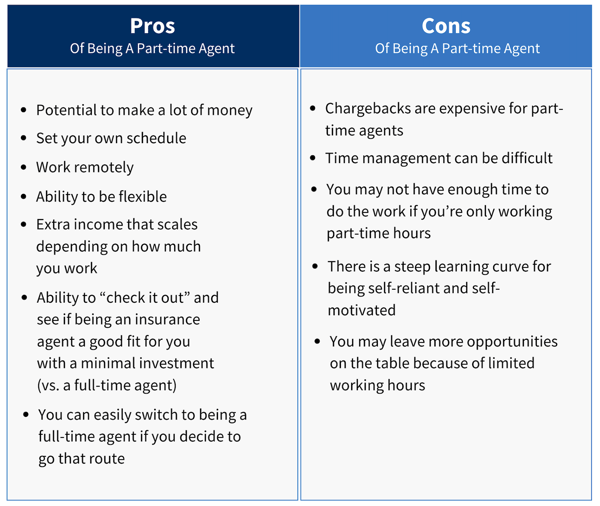

Pros & Cons Of Being A Part-Time Agent

Pros Of Being A Part-time Agent:

- Potential to make more income the more time you spend

- Set your own schedule

- Work remotely

- Ability to “check it out” and see if being an insurance agent a good fit for you with a minimal investment (vs. a full-time agent)

- Ability to be flexible

- You can easily switch to being a full-time agent in the future

Cons Of Being A Part-time Agent:

- Chargebacks could be challenging for part-time agent

- Time management can be difficult especially if you don’t have a mentor or strong training available

- You may not have enough time to do the work if you’re only working part-time hours

- There is a steep learning curve for being self-reliant and self-motivated

- You may leave more opportunities on the table because of limited working hours

Can a part-time agent switch to full time?

Absolutely! If things are going well for you as a part-time agent, you may choose to go full-time. This shift is relatively easy to do once you’ve established a part-time agency; you simply add more availability to your schedule.

Looking to connect to high intent customers? Fill your pipeline with EverQuote.

Whether you’re a brand new, part-time agent or a full-time veteran looking for a few more opportunities, if you need new clients, try EverQuote. We’re an online insurance marketplace that connects agents to consumers who are actively shopping for auto, home, and life insurance in realtime.

We’d be happy to show you around and give you an idea of what you can expect with EverQuote. Call 844-707-8800, or contact us online to get started.

Unlock predictable growth with EverQuote.

Our representatives are standing by to help you succeed.

Call 844-707-8800

Weekdays, 9AM-5PM (ET)

Call 844-707-8800

Weekdays, 9AM-5PM (ET)

Accelerate your growth.

Complete the form below or just call 844-707-8800 to learn how we can help you achieve your goals.

By clicking "Get Started", I consent by electronic signature to being contacted by EverQuote, including by automatic telephone dialing and/or an artificial or prerecorded voice (including SMS and MMS - charges may apply), regarding EverQuote for Agents, even if my phone number is listed on a Do Not Call Registry. I also understand that my agreement to be contacted is not a condition of purchasing any goods or services, and that I may call (844) 707-8800 to speak with someone about EverQuote for Agents.

By clicking "Get Started", I affirm that I have read and agree to this website’s Privacy Policy and Terms of Use, including the arbitration provision and the E-SIGN Consent.

* Mandatory fields

Product Overview

Product Overview Blog

Blog FAQs

FAQs Webinars

Webinars eBooks & Resources

eBooks & Resources