- Home»

- EverQuote Pro Blog»

- Warm Leads vs. Cold Leads: What’s the Difference?

Every sale starts as a lead, but—as salespeople in every industry know—not all leads are the same. As an insurance agent, it’s important to know the difference between warm leads vs. cold leads, and how to change your approach for each.

In this article, we’ll clarify the various types of leads and explain an approach you can use to determine where a prospect falls in the sales cycle.

Warm Leads vs. Cold Leads

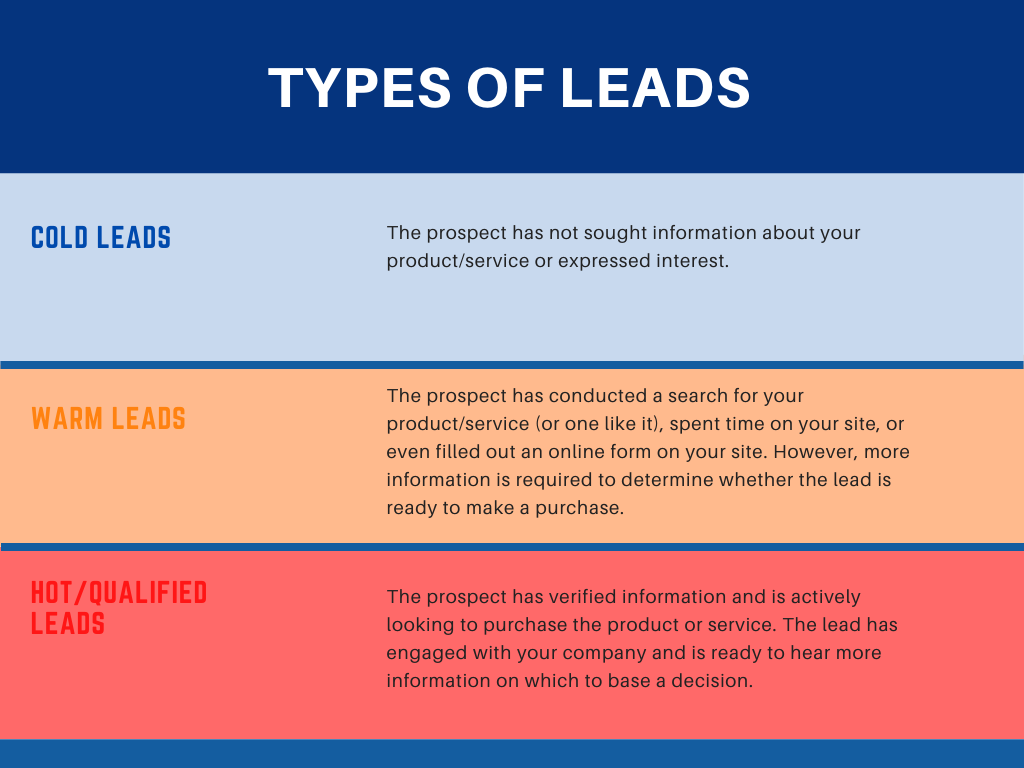

The terms warm, cold, and hot indicate how far along prospects are in the sales cycle, and give clues as to how to approach them.

What is a cold lead?

A cold lead is someone who has expressed no interest in the product or service, and has had no interaction with the product’s website. Marketers have little to go on when attempting to nurture a cold lead beyond basic contact information.

It’s difficult to quantify a cold lead because the buying process hasn’t yet begun for that consumer. You might eventually close a deal with a cold lead, however, you can expect that the process will take longer than that of a warm or hot lead.

What is a warm lead?

A warm lead, on the other hand, describes a prospect who’s actively begun looking for a product or service. The consumer may have conducted an online search for a product, submitted some of their information to a company, or spent time on a product page.

A warm lead is typically in the beginning stages of the buying process; with some nurturing they may eventually become a hot or qualified lead. For insurance agents, this is typically when you’ll reach out to the person on the phone to verify the information they have submitted online, and discuss their insurance needs.

What is a hot lead?

A hot lead—also called a qualified lead—describes a consumer who has expressed interest in your product and is ready to receive a quote.

How To Qualify Leads: The BANT Approach

Leads can go from being cold to warm to hot over time, through various interactions with a company. In some cases, cold calls establish the first interaction with a new lead. As the conversation continues and the prospect shows more interest in purchasing a product, they may eventually become a warm and then qualified lead.

Alternatively, customers may drive the progression on their own through independent research. In this case, the first time they come to the table they are already open to conversation.

Once a warm lead has been identified, insurance agents can use what’s called the BANT approach to determine which leads are most viable. BANT is an acronym that stands for the four factors that have the most influence on sales: budget, authority, need, and timeline.

- Budget—Does the prospect’s budget align with your price point? If your product or service is out of reach financially, your sales efforts aren’t likely to bear fruit.

- Authority—Is the prospect also the final decision-maker? If not, try to bring that person into the conversation.

- Need—Does the prospect have a problem you can solve? If your product isn’t a good match for their needs, it’s best to move on.

- Timeline—When are they looking to make a purchase—soon, or in a year’s time? If there’s no urgency involved, you can either help identify a need for them to buy soon (like offering a time-sensitive discount) or simply follow up with them at a later date.

Using the BANT approach successfully requires assessing these factors through natural conversation—not interrogating prospects as part of a checklist. Once you understand their needs and individual situation, it’s easier to establish how best to serve them, and hopefully move them farther down the funnel to become a hot lead.

Cold and warm leads require different approaches from insurance agents. Whether you use BANT or some other method, it’s important to implement a lead management system that will help you meet your customers where they are in the buying cycle, and present your products and services in a way that meets their needs.

Get More Warm Leads with EverQuote

For agents who need to close more business—whether they’re up against a goal, need a quick business turnaround or an injection of life into their book, or simply want to quickly bind more business—EverQuote offers high quality warm leads through our live transfer service. These warm leads simplify the insurance sales process by eliminating the variable of whether or not the prospect will answer the phone when you call.

We’d love to walk you through our live transfer leads service and explain how it could help grow your insurance agency. Click here to talk to us at EverQuote. We’d love to help set your agency up for success!

Unlock predictable growth with EverQuote.

Our representatives are standing by to help you succeed.

Call 844-707-8800

Weekdays, 9AM-5PM (ET)

Call 844-707-8800

Weekdays, 9AM-5PM (ET)

Accelerate your growth.

Complete the form below or just call 844-707-8800 to learn how we can help you achieve your goals.

By clicking "Get Started", I consent by electronic signature to being contacted by EverQuote, including by automatic telephone dialing and/or an artificial or prerecorded voice (including SMS and MMS - charges may apply), regarding EverQuote for Agents, even if my phone number is listed on a Do Not Call Registry. I also understand that my agreement to be contacted is not a condition of purchasing any goods or services, and that I may call (844) 707-8800 to speak with someone about EverQuote for Agents.

By clicking "Get Started", I affirm that I have read and agree to this website’s Privacy Policy and Terms of Use, including the arbitration provision and the E-SIGN Consent.

* Mandatory fields

Product Overview

Product Overview Blog

Blog FAQs

FAQs Webinars

Webinars eBooks & Resources

eBooks & Resources