- Home»

- EverQuote Pro Blog»

- 14 Marketing And Advertising Ideas For Life Insurance

14 Marketing And Advertising Ideas For Life Insurance

“Hard work beats talent if talent doesn’t work hard”—or so many athletic coaches like to say. Advertising is hard work, but it’s a necessary step to help you show off your talent for negotiating the best life insurance. My mission in this article is to share my most effective strategies on how to advertise life insurance, hopefully making it feel like less of a burden and more of an opportunity.

How to Advertise Life Insurance Business: 14 Ideas

Feel free to use these life insurance marketing ideas as you like: tweak them, reapply them to a different space, or mold them to your specific insurance market.

1. Send out mass mailers.

Don’t underestimate the power of physical mailers. In each, consider including a simple contact form, “Get quote” form, “Inquire about insurance protections” form, a call back number, website, SMS short code or website to collect contact information. You can find the addresses for your mailing list by getting in touch with your local public records office at the city or county level. You can even request information based on certain demographics (like new homeowners), but make sure to specify that you intend to use the information for business purposes.

When creating and addressing your mailers, don’t forget some handy tools that I’ve used before to great success—such as mail merge for personalized letters and forms, USPS tools for direct mail marketing, and even folder inserter machines to quickly get envelopes ready for mailing.

Remember: The goal here is to find people who are interested, in need of coverage, and willing to talk over options with you. That’s a powerful lead—and a relationship that can continue to grow, even before the individual decides on a purchase.

2. Go door-knocking.

This strategy works well in conjunction with the mailing lists acquired from the mailer strategy above or as a way to visit folks you can't seem to reach by phone. Depending on how well you’ve done your target demographic research, those addresses can become great door-knocking leads. You can even send mailers out first and make contact later, referring to your piece of mail as a conversation starter.

Use efficient route-planning tools like RoadWarrior to help you out—and don’t forget to leave an attractive door hanger if no one’s at home.

3. Use Facebook and Instagram ads.

Now that we’ve addressed some classic, face-to-face life insurance advertising ideas, let’s look at the powerful options you have online.

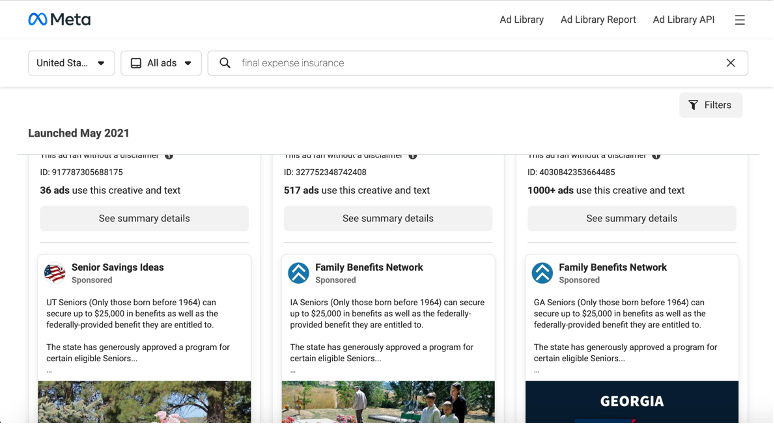

First, purchase some powerful Facebook ads. To get ideas, look at Facebook’s public Ad Library and search your target keywords, target types of ads, and ad run location. Get inspiration from what other insurance agencies and agents are doing, and research what makes their ads successful (and also pay attention to our content tips further below).

4. Use Facebook Messenger ads.

These ads are powerful because they are sent directly to individuals in your target audience and appear in their inbox like a message. Once you feel you fully know the types of people likely to become qualified leads, generate some Messenger ads and drive traffic to your Facebook page or chosen landing page.

5. Craft exciting wording about benefits.

Never underestimate the power of simple, exciting phrases used to encourage a response. Here are some phrasing examples to use in your ads, landing pages, mailers, or social posts:

- No waiting period: If you offer high-value policies with no waiting period (such as final expense policies), advertise it. This is a very attractive offer for people who need coverage quickly. You can help.

- Guaranteed approval: Advertise this feature if you’re able to deliver a policy for virtually any applicant.

- No medical exam: If you offer no-exam policies or policies with expedited medical questioning, say so. Many leads don’t want to go through the hassle and privacy invasion of a physical exam if they can help it.

- Payments never increase: This feature is a powerful angle of the life insurance industry. As medical, home, and auto insurance rates rise, it can be very attractive to know life insurance rates won’t deviate for many policies.

- Benefits never decrease: This is a reassuring offer for many.

- Benefits nontaxable: People feel more secure knowing that they can guarantee their loved ones an exact coverage amount.

- Limited time offer, special offer, or temporary promotion: Encourage a feeling of urgency to help move potential buyers down the sales funnel.

6. Choose a motivating CTA.

Explore different formats for your calls to action on social posts and ads. Encourage readers to “Get a quote,” “Visit the website,” “Learn more,” and others. Your goal is to direct people to fill out your online contact form—this is what generates great leads.

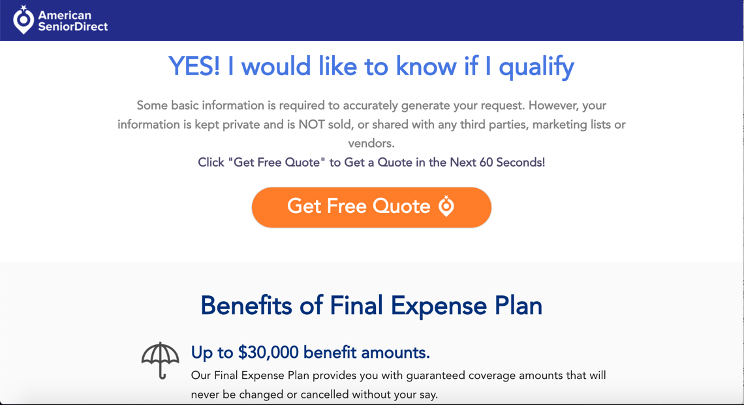

When people click, take them to a simple, informative website with features, promotions, and benefits. A great example is on American Senior Direct’s contact landing page. The CTA leading to their form offers the exciting promise of a quote, guiding people straight to a form.

7. Share special product offers.

If you work with an insurance vendor that’s offering a special policy or reward for signing up, advertise those benefits.

One successful example is the John Hancock Vitality PLUS offer, where customers who purchase life insurance with John Hancock can receive an Apple Watch for as little as $25 to start. Frequent exercise, as tracked by the watch, earns them smaller payments, which could lead to a nearly free Apple Watch. This is the perfect type of offer to advertise on your own page with an exciting picture or piece of writing—you can notify people of great deals, pique their interest, and generate leads in that way.

8. Connect with people’s emotions.

When you craft ads, don’t just think about the wording. People are visual, and you can tell an entire story with just a single picture. Don’t be afraid to use stock images of emotional or empathetic scenes to encourage web traffic.

9. Cultivate trust.

When you create a landing page or social media page, craft an agency name that sparks trust. Use words and phrases like “national” or “American;” “family,” “spouse,” or “loved ones;” and “senior,” “benefit,” “care,” or even “trust” itself. Post articles about life insurance and establish yourself as a field professional who cares and knows the best policies to choose.

Additionally, when setting up a lead generating form, ask for a personal detail for security purposes—for example, their favorite type of pet, favorite hobby, or top movie. When you call leads, referring to the answer of this question helps build a connection and spark memories of filling out your form.

10. Set up automatic messaging.

Take advantage of a program that automatically texts and emails people once they ask for contact. This article details some of the top apps currently offering this service for small businesses. Once you text or email a lead, tell them their assigned agent’s name and encourage them to schedule an appointment via a calendar link or give you a call. If you don’t receive a reply, you can always reach out yourself.

11. Pay for exposure.

Facebook and Instagram charge less for ads if you gain popularity and establish your business correctly. Sometimes, when starting off, you may need to purchase likes and run ads in order to build exposure first and foremost. Eventually, you can add more and more content geared toward your target audiences to generate leads. This strategy can help offset marketing costs in a big way.

12. Partner with a targeted website or magazine.

Contact a website directed at your target audience—such as seniors, recent retirees, or heads of households—and pay to advertise with them using banners and popup forms. This is a particularly helpful strategy since these audiences are of a specific demographic and likely to be searching for information anyway, instead of casually browsing social media.

You can also apply this strategy to a magazine or print outlet that circulates among your target demographic.

13. Partner with a call center.

Partner with a call center if the volume of calls you have to place gets too high. If this strategy is within your marketing budget, it’s always a great idea to hire phone professionals to contact people, vet leads, or connect them to you if their interest level is high.

14. Buy qualified leads.

Lastly, consider jumping straight to the bottom of the sales funnel and purchasing qualified leads from trusted sources. If you don’t have the time to gather many leads yourself, head to the experts and let them do the heavy lifting.

EverQuote has the ability to provide you with qualified life insurance leads based on millions of calls, dozens of best practices, and years of experience. We’ve helped hundreds of agents accelerate their growth—you can read about some of our success stories here. Contact us anytime to get started!

Unlock predictable growth with EverQuote.

Our representatives are standing by to help you succeed.

Call 844-707-8800

Weekdays, 9AM-5PM (ET)

Call 844-707-8800

Weekdays, 9AM-5PM (ET)

Accelerate your growth.

Complete the form below or just call 844-707-8800 to learn how we can help you achieve your goals.

By clicking "Get Started", I consent by electronic signature to being contacted by EverQuote, including by automatic telephone dialing and/or an artificial or prerecorded voice (including SMS and MMS - charges may apply), regarding EverQuote for Agents, even if my phone number is listed on a Do Not Call Registry. I also understand that my agreement to be contacted is not a condition of purchasing any goods or services, and that I may call (844) 707-8800 to speak with someone about EverQuote for Agents.

By clicking "Get Started", I affirm that I have read and agree to this website’s Privacy Policy and Terms of Use, including the arbitration provision and the E-SIGN Consent.

* Mandatory fields

Product Overview

Product Overview Blog

Blog FAQs

FAQs Webinars

Webinars eBooks & Resources

eBooks & Resources