- Home»

- EverQuote Pro Blog»

- Insurance Agent Salary Ranges (And How To Set One For Your Next Hire)

Insurance Agent Salary Ranges (And How To Set One For Your Next Hire)

.jpg?width=1834&name=Insurance%20Agent%20Salary%20Ranges%20For%202019%20(And%20How%20To%20Set%20One%20For%20Your%20Next%20Hire).jpg)

Interested in insurance agent salaries? Whether you’re looking to add agents or producers to your team or you yourself are interested in becoming an insurance agent, you probably have questions about agent income. Here are a few common questions we receive about average salaries across the insurance industry, as well as salary data by state, insurance agent type, and insurance carrier.

What is the average salary of an insurance agent?

The Bureau of Labor Statistics (BLS) projects that the number of insurance agent jobs will grow 10% (faster than average) over the next eight years. (Tweet this!) According to BLS, the median annual income for agents in 2017 was $49,710. The highest 10 percent of agents earned more than $125,190, while the lowest 10 percent of agents earned less than $27,180. Also, agents in different insurance industries make different amounts. According to the BLS, employment in the health and medical insurance industry segment is expected to grow the most through 2026. In addition, agents who have experience with a wide range of insurance and financial products are expected to have the best job prospects.

For entry-level insurance agents in 2019, starting income ranges from $29,000 (25th percentile) to $94,000 (75th percentile) across the United States.

It’s important to note that using the term “salary” in this context is misleading—in general, commissions are the most common form of compensation, especially for experienced agents.

Factors affecting commissions include the type and amount of insurance sold and whether the transaction is a new policy or a renewal. Other compensation includes bonuses for meeting sales or profit goals. Also some agents involved with financial planning charge a fee for their services rather than receiving a commission.

Lay a strong foundation for building your agency with these expert tips. Download 5 Smart Ways To Set Up Your Auto Insurance Agency For Success.

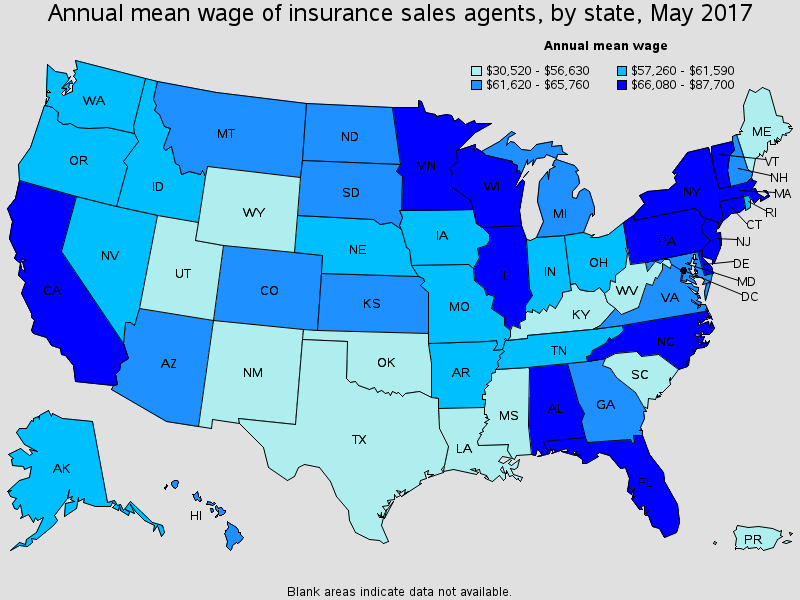

Breakdown Of Insurance Agent Pay Ranges By State

Below are the states where insurance agents had the highest annual average incomes in 2017, per BLS:

- Massachusetts: $87,700

- New York: $87,220

- Pennsylvania: $82,790

- Minnesota: $82,760

- Alabama: $78,860

Source: BLS (note: “wage” refers to total income)

Breakdown Of Insurance Agents By Type

Of the approximately 501,400 insurance agents working in 2016, the largest employers of insurance sales agents were as follows:

- Insurance agencies and brokerages: 54 percent

- Self-employed workers: 18 percent

- Direct insurance carriers (P&C excluding life and health/medical): 9 percent

- Direct health and medical insurance carriers: 4 percent

Breakdown Of Insurance Agent Pay By Employer

According to a survey of 3,662 insurance agents, here’s a look at the average annual income by employer:

- NY Life: $44,000

- USAA Insurance: $42,545

- AAA Insurance Company: $42,500

- GEICO: $37,641

- Nationwide Mutual Insurance Company: $36,000

- Allstate: $34,946

- Farmers Insurance Group: $34,588

- State Farm Insurance Company: $32,859

- Liberty Mutual: $31,600

Looking for help with next steps?

Whether you’re interested in hiring new agents or you’ve chosen to become an agent yourself, you’ll need leads to fill up your pipelines. We can help. People who come to EverQuote are already looking for insurance products; we then provide that lead information to agents like you, in real time. You can schedule a call to talk with us about our process here.

Unlock predictable growth with EverQuote.

Our representatives are standing by to help you succeed.

Call 844-707-8800

Weekdays, 9AM-5PM (ET)

Call 844-707-8800

Weekdays, 9AM-5PM (ET)

Accelerate your growth.

Complete the form below or just call 844-707-8800 to learn how we can help you achieve your goals.

By clicking "Get Started", I consent by electronic signature to being contacted by EverQuote, including by automatic telephone dialing and/or an artificial or prerecorded voice (including SMS and MMS - charges may apply), regarding EverQuote for Agents, even if my phone number is listed on a Do Not Call Registry. I also understand that my agreement to be contacted is not a condition of purchasing any goods or services, and that I may call (844) 707-8800 to speak with someone about EverQuote for Agents.

By clicking "Get Started", I affirm that I have read and agree to this website’s Privacy Policy and Terms of Use, including the arbitration provision and the E-SIGN Consent.

* Mandatory fields

Product Overview

Product Overview Blog

Blog FAQs

FAQs Webinars

Webinars eBooks & Resources

eBooks & Resources